Lafayette business owner arrested for felony tax evasion

Published 2:28 pm Wednesday, December 2, 2015

BATON ROUGE – A Lafayette man faces multiple felony charges for failing to report and pay taxes on hundreds of thousands of dollars in income.

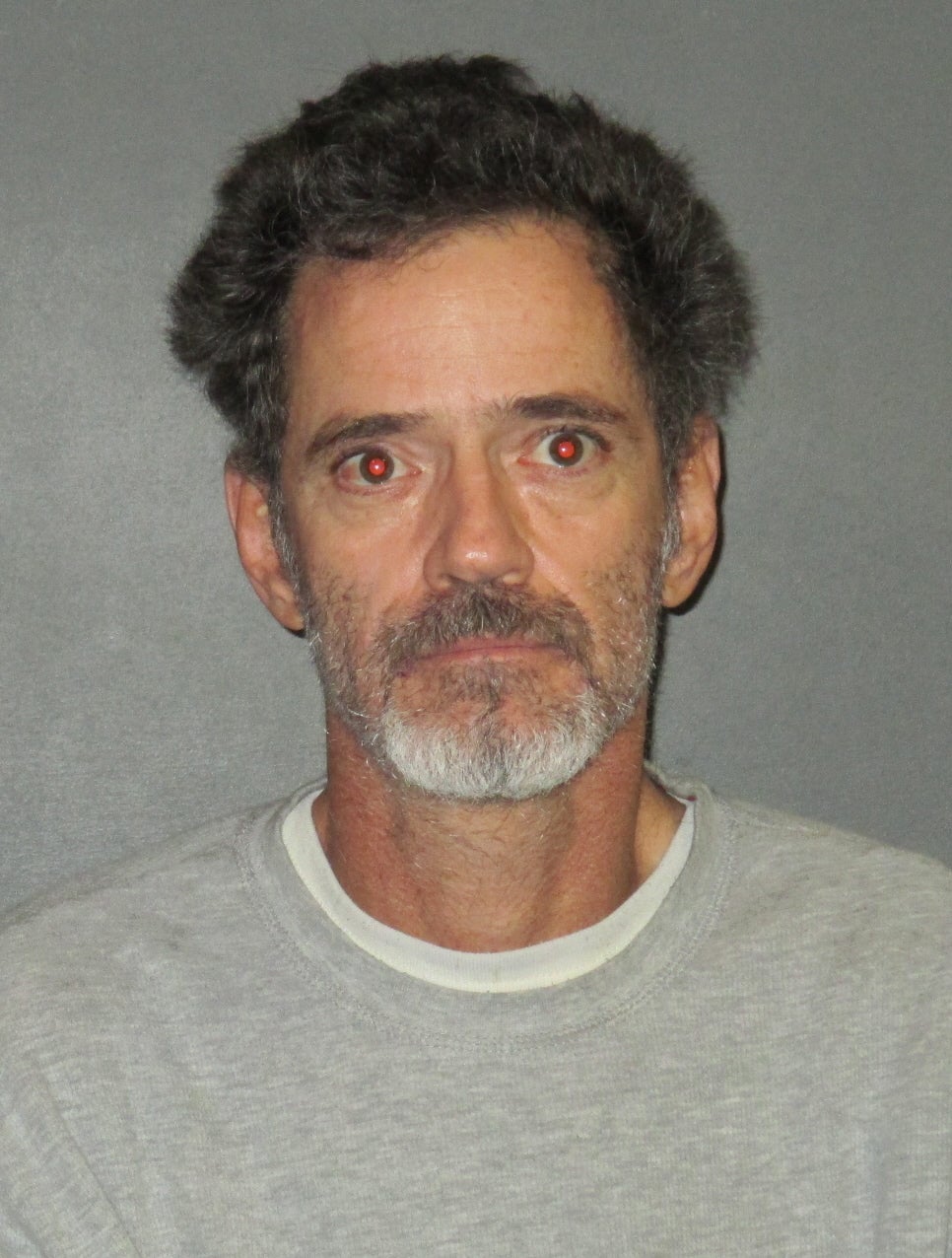

Alan J. Bernard, of 721 W. Gloria Switch Road in Lafayette, is the 54th person arrested under a joint anti-fraud initiative of the Louisiana Department of Revenue (LDR) and the state Attorney General’s office.

Investigators with the LDR Criminal Investigation Division say that as the owner of A-Team Home Improvements, LLC, Bernard filed state tax returns reporting no income from that business in 2012 and 2013. But banking records obtained by subpoena and Bernard’s federal tax returns show the business produced income of $144,036.97 in 2012 and $324,396.75 in 2013. Bernard failed to pay any state corporate, sales, or income tax on those amounts.

Bernard was booked Tuesday into the East Baton Rouge Parish Prison on charges of criminal penalty for evasion of tax, criminal penalty for failing to account for state tax monies and filing or maintaining false public records.