Comptroller distributes over $1.5 Million in monthly sales tax revenue to OC entities

Published 12:20 am Saturday, December 11, 2021

|

Getting your Trinity Audio player ready...

|

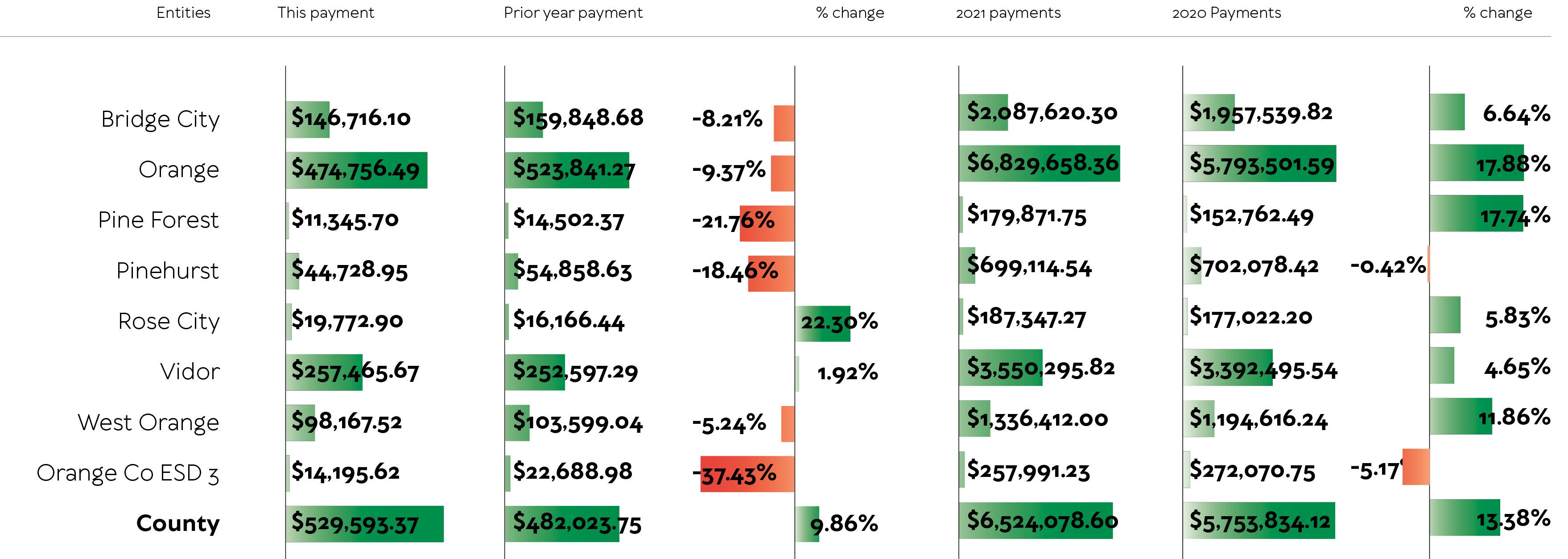

Texas Comptroller Glenn Hegar announced he will send cities, counties, transit systems and special purpose taxing districts $936 million in local sales tax allocations for December, 18.4 percent more than in December 2020. These allocations are based on sales made in October by businesses that report tax monthly. For Orange County entities, it means $1,596,742.32 this year. An amount which is over $33,000 less than the previous year of $1,630,126.45 for this payment.

Rose City, Vidor and the County are the only entities this payment being above the same payment a year ago.

Rose City had a 22 plus percent increase from the previous payment in 2020 when comparing $19,772.90 in 2021 to $16,166.44 in 2020. The payment also had the year-to-date (YTD) payments reflecting an almost six percent increase over last years YTD when comparing $187,347.27 in 2021 YTD to $177,022.20 YTD in 2020.

Vidor received almost two percent more this payment and over four and half percent for YTD payments.

The County received almost 10 percent more this period when comparing $529,593.37 in 2021 to $482,023.75 in 2020. For YTD the County has received over 13 percent more when comparing $6,524,078.60 YTD in 2021 to $5,753,834.12 YTD in 2020.

The largest YTD difference was almost 18-percent for the city of Orange when comparing $6,829,658.36 in YTD 2021 to $5,793,501.59 in YTD 2020 payments. For payments this period, the city saw a decrease of over none percent when comparing $474,756.49 this year to $523,841.27 last year for the same period.

While the city of Pine Forest received almost 22 percent less this payment, for YTD is has received almost 18 percent more in payments when comparing $179,871.75 YTD in 2021 to $152,762.49 YTD in 2020.

Orange County ESD 3 received over 37 percent less in payments this period when comparing $14,195.62 for this payment in 2021 to $22,688.98 in 2020. The entity also so less in YTD payments when comparing $257,991.23 in YTD in 2021 to $272,070.75 YTD in 2020. The difference is approximately five percent less.