Understanding a City Budget

Published 9:29 am Wednesday, July 29, 2015

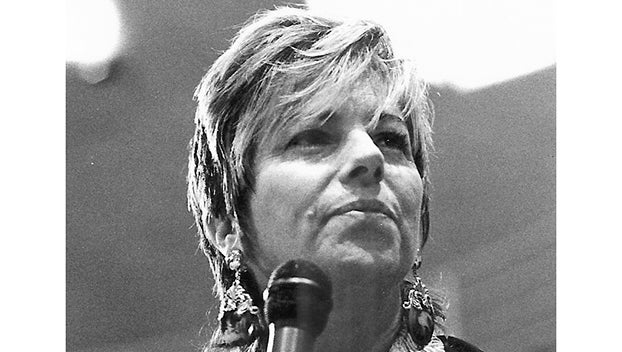

By Mayor Jimmy Sims

I want to use this piece to discuss what makes up the City’s budget. The budget is made up of three general areas each having revenues and expenses but, are used to fund different parts of the City’s operations.

The General Fund represents the largest operation of the City. This fund pays for police, fire, street, drainage, building services, library, and administration. The cost to provide these services comes from property taxes, Industrial District Contracts (IDC), sales tax collections, and franchise fees to name a few. The expenditures for the General Fund for this fiscal year are $17,962,196.00.

The City Council has spent the last few years renegotiating the IDC which represents payments by industry in lieu of being in the city limits. This affords industry the ability to operate with the flexibility needed to be a global competitor and also affords the City to collect payments from industry by providing limited negotiated services between parties. It was this synergy between industry and the City that has allowed the residents, businesses, and industry to appreciate the lowering of the tax rate by 20-percent since 2005.

The second component of the budget is called the Enterprise Fund. This area represents water, sewer, garbage, grapple truck, and the street sweeper. Operations of these departments are self-sufficient based on the fees collected to provide such services. They are not supported by any property tax, IDC, or sales tax. The operational costs for these departments are $7,201,602.00.

The third component of the budget is called the Restricted Fund. This fund represents expenses that are only permitted for certain services such as economic development, Hotel/Motel tax collections, and grants which may come from the state or federal level or private donations.

The Citizens elected to have a 4B Economic Development Corporation. This dedicates one half of one cent of the sales tax collections to retain, expand, or relocate businesses into the City. It can also be used for city infrastructure or public use projects such as the boat ramp or downtown pavilion.

The Hotel/Motel tax is collected by local hotel operators from visitors staying in our local hotels. These funds can be used to enhance and promote tourism and promote the arts. The City funds things such as the Lutcher Theater, Mardi Gras, BASS Event, Save the Train Depot, and the Heritage House Museum. The funds given to the applicants last year totaled $148,000.00

This is a brief overview of the City’s annual budget. It is a constant shifting and meeting of competing interests. I want to assure you that the priority of Council and the direction given to staff is to make efficient use of the resources entrusted to the Council and staff by the Citizens of Orange. We appreciate the confidence that you have in Council to manage your tax dollars and will continue to provide quality services to the Citizens of Orange.

We always welcome citizens participation in their government and encourage them to attend our Council Meetings. The Council Meetings are held on the second and fourth Tuesday of each month. The second Tuesday meeting of the month is held at 9:00 am and the fourth Tuesday meeting of the month is held at 5:30 pm. These meetings are held at 220 North 5th Street in the Council Chambers.

I look forward to discussing future topics with you. If you have a topic of particular interest, please contact me at 409-883-1016 and I will include it in a future discussion. The Council, staff, and I are here to serve the Citizens of Orange.

Jimmy Sims is the City of Orange Mayor.