Sales tax revenue moving in right direction

Published 1:29 pm Wednesday, August 16, 2017

By Dawn Burleigh

The Orange Leader

Texas Comptroller Glenn Hegar announced, on Wednesday, he will send cities, counties, transit systems and special purpose taxing districts $779.2 million in local sales tax allocations for August, 1.3 percent more than in August 2016. These allocations are based on sales made in June by businesses that report tax monthly, and sales made in April, May and June by quarterly filers.

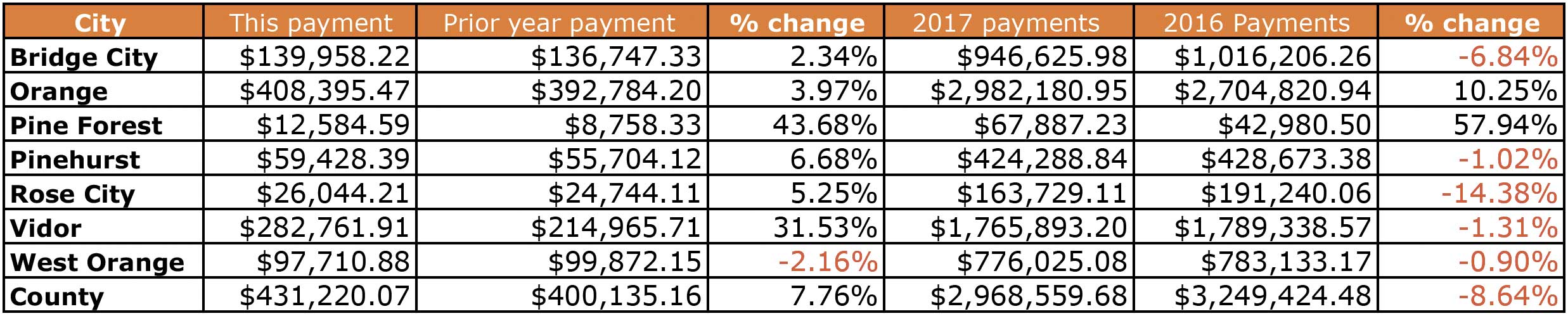

Orange County will receive 7.76 percent more in sales tax revenue this month compared to last year for the same time for the results of July.

The county is still behind by 8.84 percent for the year compared to this time last year. A promising result after watching the numbers stay in the negative, sometimes as much as by double digits, for 2017 thus far.

West Orange will receive $97,710.88 for August 2017, 2.16 percent less than the same month in 2016 when it received $99,872.15. For year to date, the city is 0.9 percent behind compared to 2016 figures.

City of Orange, for year to date, has 10.25 percent more in collections of sales tax revenue with $2,982,180.95 this month compared to $2,704,820.94 in 2016. This month, the city is ahead in collections by 3.97 percent with $408,395.47 compared to the same month last year when it collected $392,784.20 for the same month.

While Vidor saw the second highest percentage of change for the same month with 31.58 percent increase, the entity is still behind by 1.31 percent in overall collections for the year with $1,765,893.20 so far in 2017, compared to $1,789,338.57 in 2016.

The city of Pinehurst will receive a 6.68 percent increase in sales tax revenue for the month compared to the same month in 2016. The city is behind in year to date collections by 1.02 percent.

Bridge City also will see an increase in sales tax revenue collections with a this payment at $139,958.22 compared to 2016’s payment of $136,747.33. Overall, the city is behind in collections by 6.84 for year to date payments in 2017 compared to 2016.

Texas, along with most other states, uses a state-administered system of local sales taxation. Sellers collect both state and local taxes from customers at the time of the transaction and remit them, generally on a monthly basis, to the Comptroller’s office.

After processing, the Comptroller returns local tax revenue to the appropriate jurisdictions. The taxing jurisdictions thus avoid the tasks of collecting, accounting for, auditing, enforcing and administering their own tax systems, according to an article published by the Comptrollers Office.